Taxpayer Relief Act 2026 Status

Taxpayer Relief Act 2026 Status – The American Taxpayer Relief Act of 2012 is a United States federal statue enacted in 2012 to address certain aspects of the so-called Fiscal Cliff, i.e. certain mandatory tax increases and budget . Download and save the PDF to your computer Open the downloaded PDF in Acrobat Reader 10 or later A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. .

Taxpayer Relief Act 2026 Status

Source : www.taxpolicycenter.org

Estate Tax – Current Law, 2026, Biden Tax Proposal

Source : www.krostcpas.com

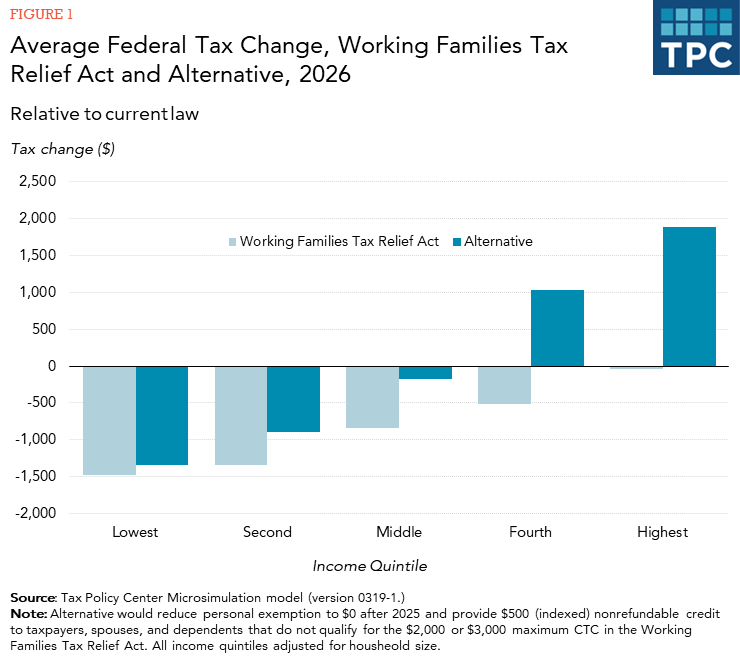

Working Families Tax Relief Act Provides Substantial Benefits

Source : www.taxpolicycenter.org

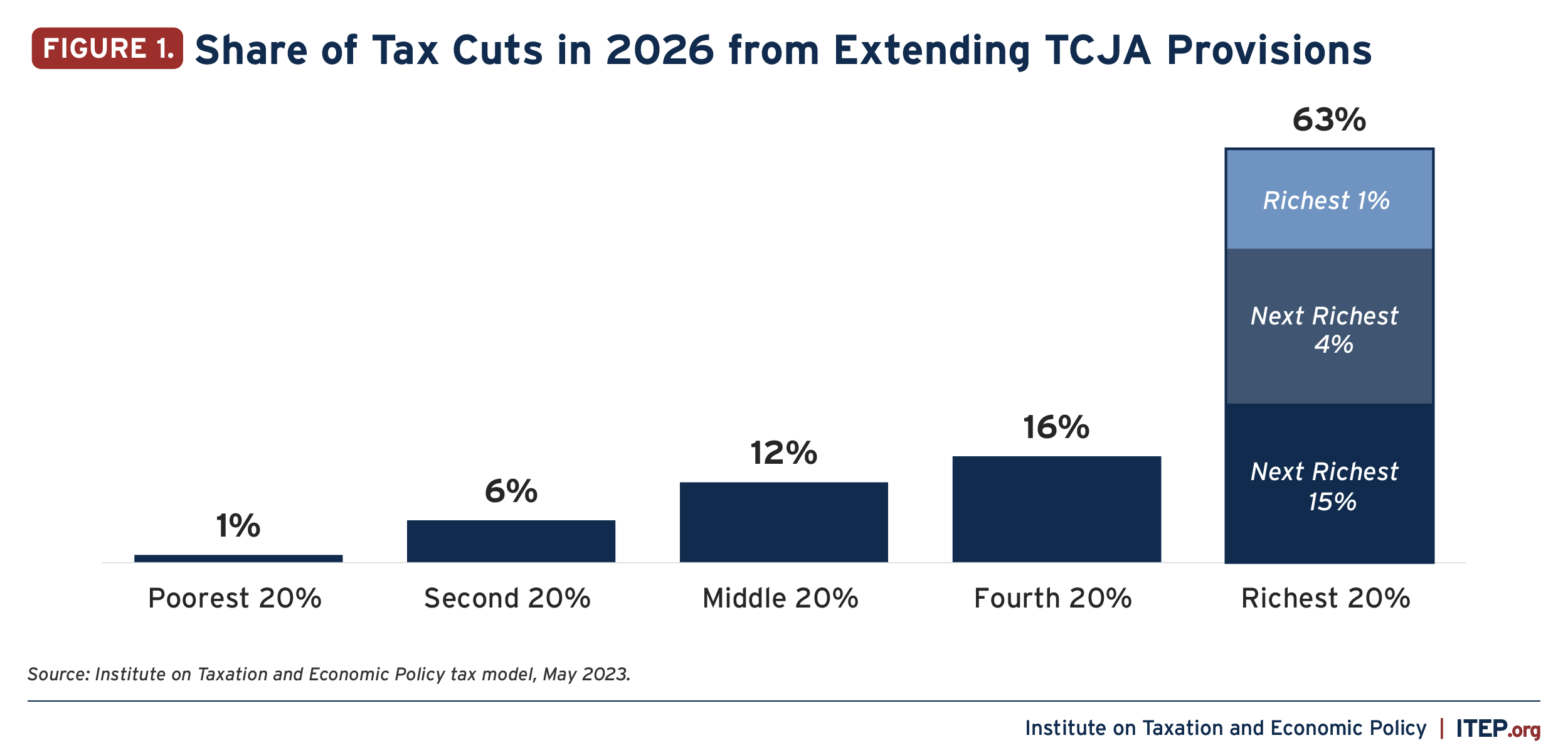

Extending Temporary Provisions of the 2017 Trump Tax Law: National

Source : itep.org

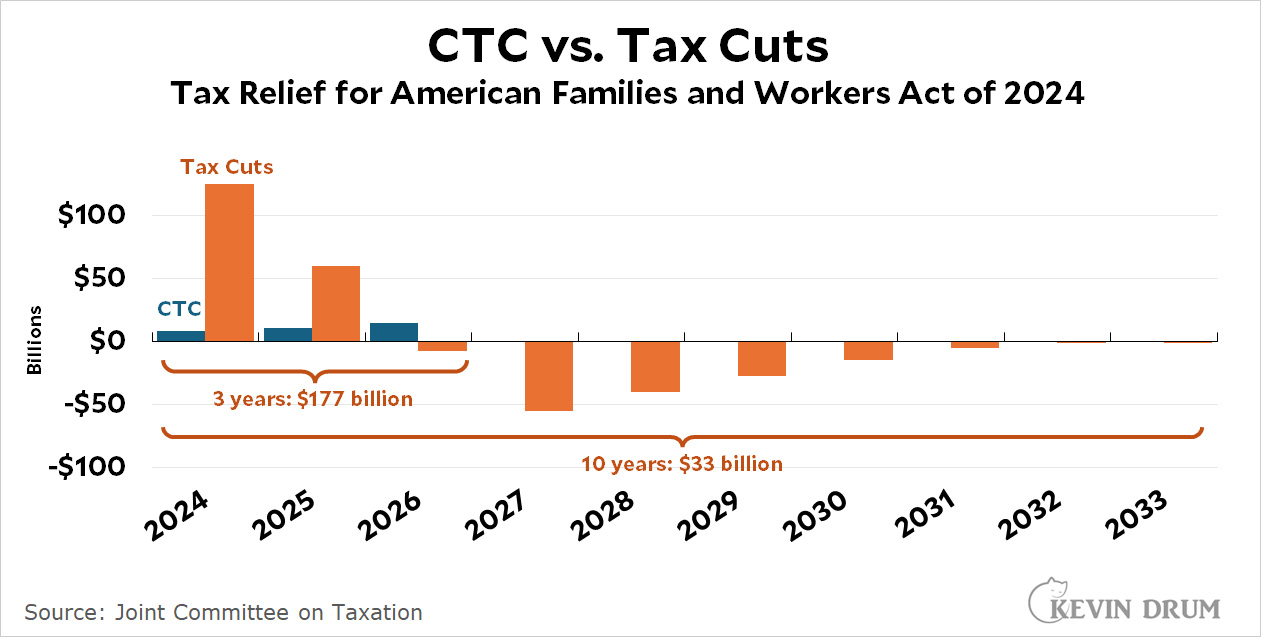

Maybe that Child Tax Credit bill isn’t so great after all – Kevin Drum

Source : jabberwocking.com

New property tax relief for N.J. seniors is now law. But will full

Source : www.nj.com

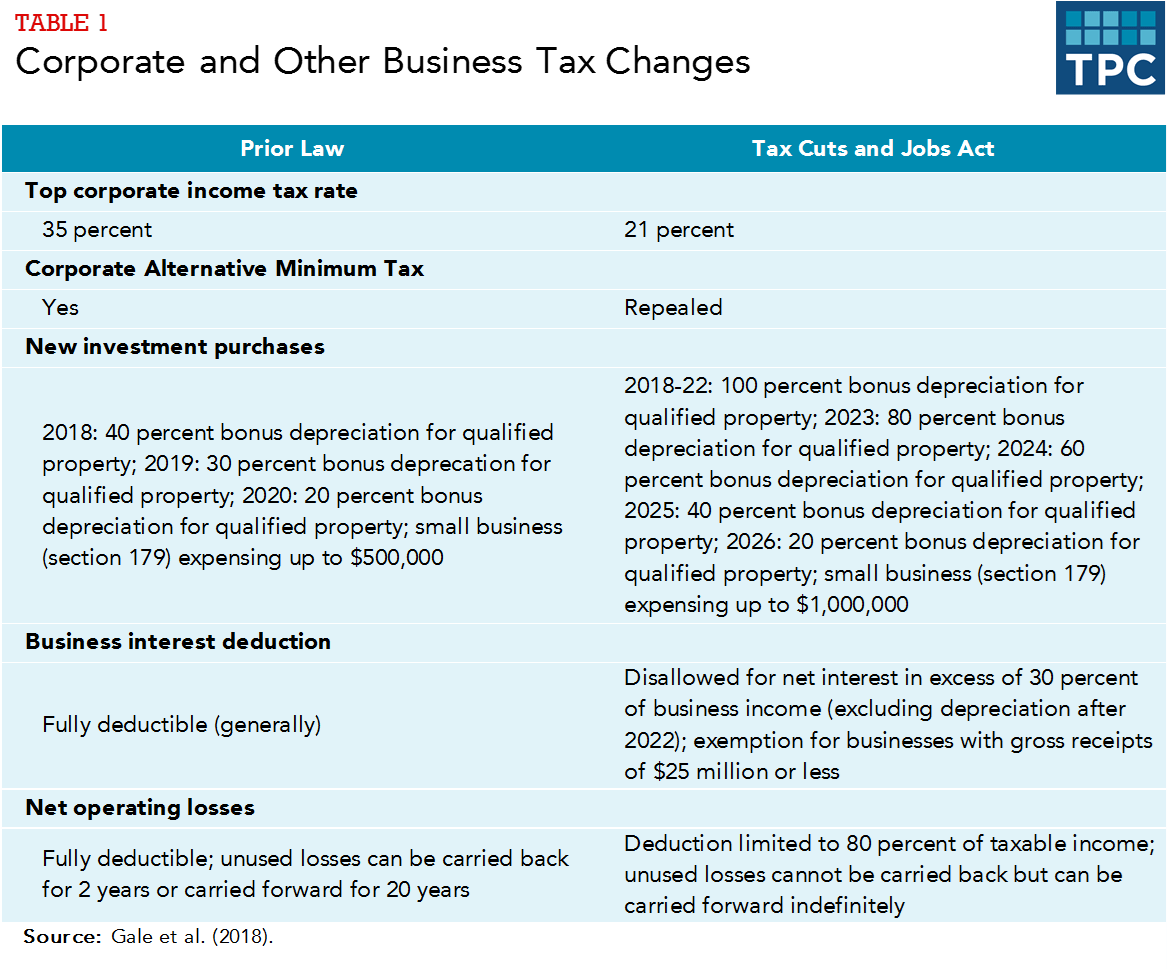

How did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org

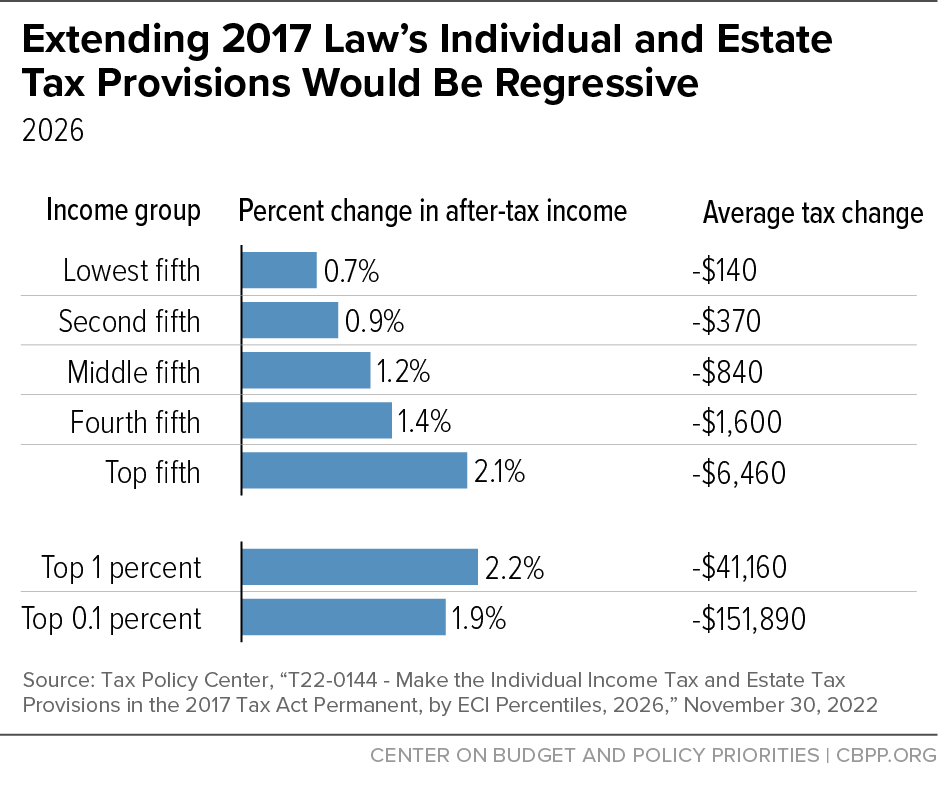

After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Source : www.cbpp.org

Who pays the AMT? | Tax Policy Center

Source : www.taxpolicycenter.org

QuickStudy Federal Income Tax Laminated Study Guide (9781423246183)

Source : www.barcharts.com

Taxpayer Relief Act 2026 Status T20 0030 Number of Tax Units by Tax Bracket and Filing Status : While BCCI claims exemption under the relevant section of the Income Tax Act, the Income Tax department has challenged this claim, leading to a sub judice status. The government Loss account is . Margin loan rates from 5.83% to 6.83%. Originally enacted as part of the Taxpayer Relief Act of 1997, the child tax credit was initially a $500 nonrefundable credit that could be applied by .